Many states have laws that regulate how attorneys can maintain lawyers' trust accounts.

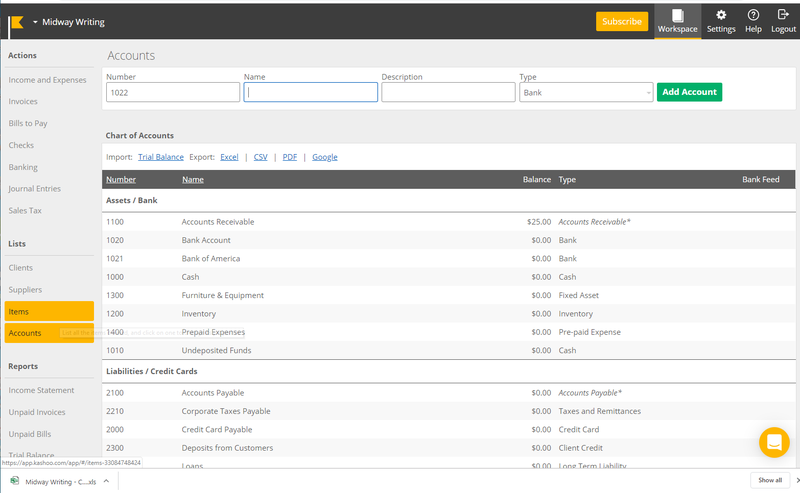

SIMPLE ACCOUNTING SOFTWARE WITH CHART OF ACCOUNTS MANUAL

Some systems will apply trust monies directly through automatic billing, keeping the accounts balanced without the need for manual transactions. Organize by legal matter or client to customize according to your preference.įor accounts that qualify, track the interest accrued, make automatic payments into the program and make sure you are abiding by the IOLTA rules of your state. Track the ledgers of multiple accounts for multiple clients, avoiding the mistake of commingling accounts. Some trust accounting software integrates with general legal accounting software, so all financial records are housed in the same database and trust accounts match up with overall financials.

This also allows you to reconcile trust accounts every month and be audit-ready should the need arise.Īlmost all trust accounting software integrates with (or comes in a suite with) more generalized legal billing/timekeeping software that allows for easy creation of invoices and payment collection, while squaring those exchanges with trust accounts. Lawyers must be able to produce a report showing how funds in a trust account are used. Financial reportingĬreate financial statements tracking funds across multiple trust accounts. The most typical features are explained in the following chart. The products we'll be discussing in this guide are specifically geared toward legal trust accounting, though we will be referring to it as "trust accounting" for simplicity's sake.ĭifferent trust accounting systems will have different features, depending in part on how integrated they are with a more robust suite of legal and/or accounting software. One of the main features of legal trust accounting software is automated management and accounting of those IOLTA funds, making lawyers the primary customers of trust accounting software vendors. The client-and not the IOLTA program-receives the interest if the funds are large enough or will be held for a long enough period of time to generate net interest that is sufficient to allocate directly to the client." Client funds are deposited in an IOLTA account when the funds cannot otherwise earn enough income for the client to be more than the cost of securing that income. All 50 states currently have an IOLTA program.Īccording to the program's website, "A lawyer who receives funds that belong to a client must place those funds in a trust account separate from the lawyer's own money.

In many cases, these trusts are eligible for the IOLTA (Interest on Lawyers Trust Accounts) program, which takes the interest from lawyers' trust accounts and uses it to provide legal aid on civil matters to low-income families and individuals. They are holding client funds as a fiduciary for that clientīy law, these accounts must be separate from the lawyer's own personal or business account, making legal trust accounting an essential part of legal practice and ethics.They are holding funds for clients in connection with payment of a settlement.They have been given advance fees (such as retainers) by clients.Lawyers create legal trust accounts for a few reasons, including: Although legal firms are frequently involved in trust accounting for estate planning and other purposes, "legal trust accounting" refers to a different, separate practice. When talking about general trust accounting, though, we are more specifically referring to accounts created as a part of estate planning (the dispersal and management of a person's assets after their death).Īdding to the confusion is the fact that this form of trust accounting, or "fiduciary accounting," has a counterpoint in the legal profession. In its largest sense, the term "trust accounting" refers to the financial management of trust accounts-accounts in which a trustee holds funds for some specific purpose. This buyer’s guide will not only serve as a primer on what trust accounting is, but also explain what specific things software buyers should look out for if they’re in the market for a trust accounting system.Ĭommon Features of Trust Accounting Software Dedicated software can make trust accounting easier to handle, but successful implementation requires an understanding of specifically how that software can help lawyers, accountants and other parties manage trust funds and the assets that those funds produce. Trust accounting is a complex, niche field that spans the financial and legal industries.

0 kommentar(er)

0 kommentar(er)